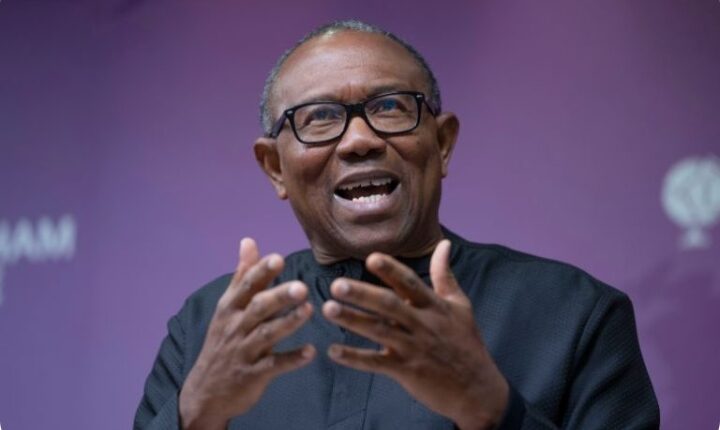

PETER OBI CALLS FOR SUSPENSION OF CONTROVERSIAL TAX LAWS

Former presidential candidate and chieftain of the African Democratic Congress (ADC), Peter Obi, has called on the Federal Government to suspend the implementation of the newly introduced tax laws, warning that they are poorly structured and unfair to Nigerians already battling severe economic hardship.

Obi made the call in a post shared on his official X (formerly Twitter) account, where he raised concerns over recent changes to the country’s tax system, describing them as confusing, inconsistent, and detached from the realities faced by ordinary citizens.

According to Obi, the new tax framework contains serious flaws, noting that global accounting firm KPMG reportedly identified 31 major issues, including drafting errors, policy conflicts, and administrative gaps. He expressed concern that these problems only became apparent after private engagements between the National Revenue Service and KPMG.

The former Anambra State Governor argued that if professionals require closed-door technical discussions to understand the tax laws, it would be even more difficult for everyday Nigerians to comprehend what is being demanded of them.

Obi stressed that taxation goes beyond revenue generation, describing it as a social contract between the government and the people; one that depends on transparency, understanding, and trust. He warned that such a contract cannot function where citizens neither understand the rules nor trust the institutions enforcing them.

He further noted that in many countries, tax policies are supported by visible public benefits such as quality healthcare, improved education, job creation, infrastructure development, and strong social safety nets. In contrast, he said Nigeria’s approach appears focused on revenue collection without clearly demonstrating what citizens gain in return.

The former presidential candidate also criticised the absence of wide consultations before the tax laws were finalised. He explained that global best practices require governments to engage businesses, labour groups, and civil society for extended periods before implementing tax reforms, ensuring clarity and buy-in from the public.

Obi observed that this process was largely missing in Nigeria, leaving citizens confused and uncertain about the purpose and implications of the new tax regime.

He added that enforcement is being pushed despite the lack of consensus, at a time when Nigerians are still struggling with the effects of fuel subsidy removal, rising food prices, high transportation costs, declining purchasing power, and growing poverty.

Obi warned that introducing a complex and inconsistent tax system under such conditions reflects poor governance, noting that taxation without trust feels like punishment, while taxation without clarity creates hardship.

He urged the Federal Government to halt the implementation of the tax laws, engage Nigerians more openly, and build national consensus before proceeding.

According to him, meaningful reform can only be achieved through trust, understanding, and shared benefits, adding that rebuilding Nigeria is no longer optional but an urgent necessity.