Group request Tax bill review as Northern Governors divide in opinions

The ongoing debate over President Bola Tinubu’s proposed tax reform bills has created divisions within the Nigerian House of Representatives, with lawmakers from northern Nigeria expressing concerns about the legislation.

While some lawmakers support advancing the bills, northern leaders, including former Kano State Governor Ibrahim Shekarau, are calling for a review, citing significant issues that need to be addressed.

The bills, submitted to the National Assembly in October after receiving approval from the Federal Executive Council, aim to reform Nigeria’s tax system and enhance revenue generation. The four key bills Nigeria Tax Bill 2024, Nigeria Tax Administration Bill, Nigeria Revenue Service (Establishment) Bill, and Joint Revenue Board (Establishment) Bill are central to this initiative.

READ ALSO: FCT Minister revokes lands of Buhari and top Government officials

At the presentation of the technical committee’s findings in Abuja, Shekarau, representing the League of Northern Democrats, expressed cautious optimism about the potential benefits of the reforms but stressed that certain provisions in the bills could negatively affect northern Nigeria. He called for a careful review to address these concerns.

“We see the tax reforms as crucial for economic growth, but the concerns of Nigerians, especially in the north, must be taken into account,” Shekarau said, pointing to specific sections, such as those related to inheritance laws and tax exemptions, which could clash with religious and cultural practices in the north.

The LND’s technical committee, led by Bala Ibn Na’Allah, also raised concerns about the informal sector, tax compliance, and resource distribution, suggesting that amendments be made to better reflect the unique economic realities of Nigeria’s diverse regions.

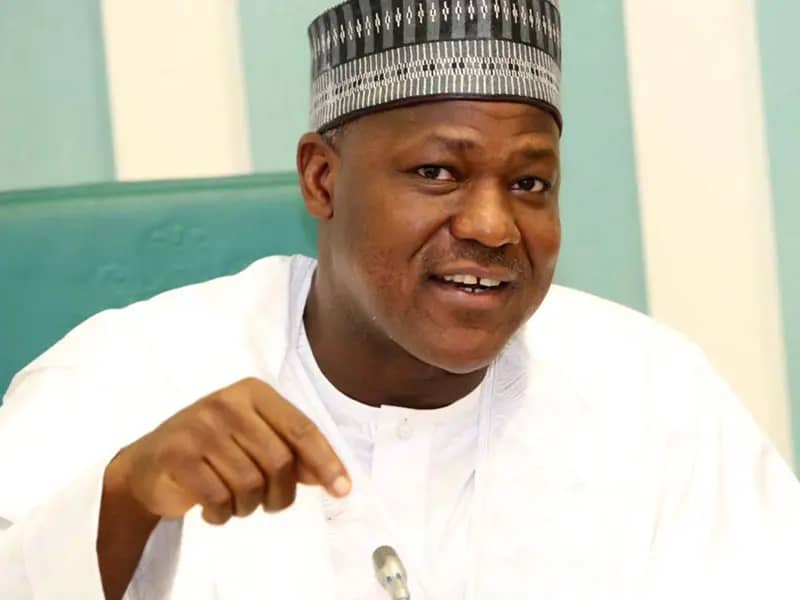

Former Speaker Yakubu Dogara has criticized northern governors for rejecting the tax reform bills. Speaking at a town hall for Christian leaders in northern Nigeria, Dogara blamed the region’s underdevelopment on poor resource management rather than the proposed reforms.

“The issue is not with the tax reform bills, but with the mismanagement of resources by our leaders,” Dogara said, pointing out that northern Nigeria continues to lag behind despite receiving substantial federal allocations. He urged northern leaders to take responsibility for the region’s lack of development and stop blaming external factors or the tax reforms.

As the debate continues in the House of Representatives, lawmakers are split. Some southern lawmakers, such as Oluwole Oke (PDP, Osun), believe the bills will progress to a second reading despite northern opposition. Oke expressed confidence that the concerns raised by northern lawmakers would be addressed through amendments and exemptions.

On the other hand, northern lawmakers, particularly from the Northeast, remain firm in their stance, arguing that the bills, as currently drafted, may negatively impact their region. A source revealed that a meeting between the Speaker and northern governors earlier this week did not change the region’s position.

The disagreement between Dogara’s comments and Shekarau’s call for review highlights the regional divide over the tax reform. While the North demands amendments to the bills, others argue that the reforms are necessary to tackle Nigeria’s economic challenges and boost national revenue.

As the National Assembly continues to examine the bills, it remains uncertain whether lawmakers can reconcile regional concerns with the need for national economic reform. However, there is broad agreement that Nigeria’s tax system must be overhauled to better align with the country’s economic realities and improve revenue generation.

The passage of these bills will be a critical moment in Nigeria’s efforts to modernize its tax system, but it will require careful negotiation and compromise to ensure all stakeholders are heard and that the country can move toward a more sustainable economic future.

[…] READ ALSO: Group request Tax bill review as Northern Governors divide in opinions […]